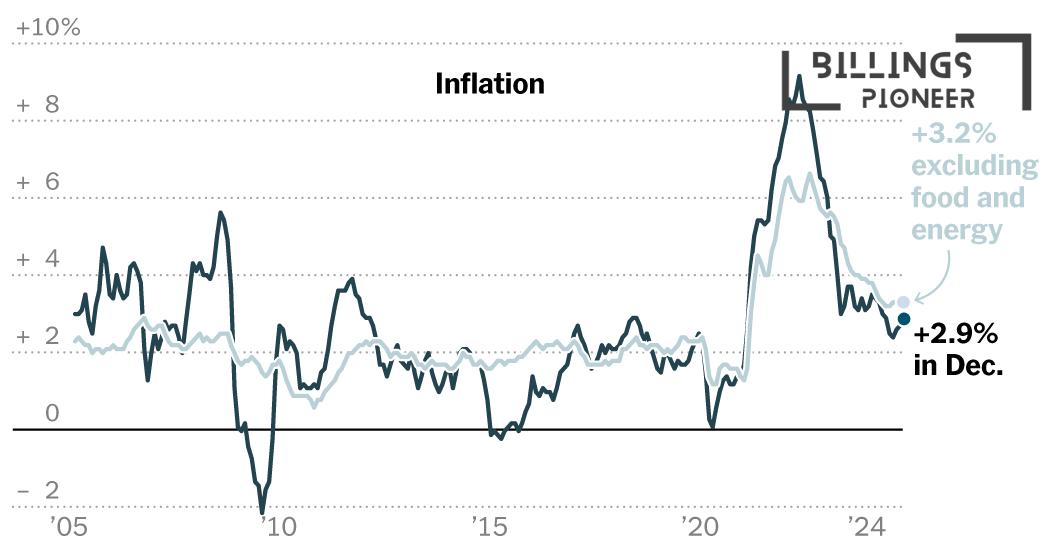

The Consumer Price Index (CPI) is making headlines as it provides important clues about the economy. Recently, consumers and businesses have been on the lookout for news regarding how inflation is impacting prices and interest rates. In December, CPI data suggests that inflation is stabilizing, leading the Federal Reserve to consider keeping interest rates steady this month. This comes after three consecutive rate cuts, causing many to wonder what is next for the economy and their wallets.

What is CPI and Why Does It Matter?

The Consumer Price Index (CPI) tracks the prices of everyday goods and services, from food to housing. When CPI increases, it usually means that things are getting more expensive. On the other hand, if it stays stable or decreases, it can be a sign of a healthy economy. For many families, understanding CPI can help in budgeting money and planning monthly expenses.

Interest Rates and Your Wallet

Interest rates are crucial because they affect loans, mortgages, and even savings accounts. When the Federal Reserve lowers rates, borrowing money gets cheaper, which can encourage spending and boost the economy. However, if rates are too high, it can make loans expensive, causing people to hold back on spending. As the Fed looks at the latest CPI numbers, they may decide to keep rates steady to support economic stability.

CPI’s Effects on Housing Prices

- In December, housing costs only rose by 4.6 percent year-over-year, marking a near three-year low.

- Families looking to buy a home may feel some relief as prices become less volatile.

- With lower inflation in housing, it could also mean more affordable rental rates for many families.

The decrease in housing inflation signifies that prices may not continue to climb as rapidly as they had, easing concerns for both renters and home buyers.

The Stabilizing Labor Market

Another factor influencing the decisions at the Federal Reserve is the labor market. With unemployment remaining low, more people are working and having a steady income. This situation is good for families, as it means more money flow in the economy. However, it also means that inflation might remain stubbornly above the Fed’s desired levels. Bank of America economist Aditya Bhave highlighted that this stabilizing workforce pushes the Fed to pause further interest rate cuts for now.

Looking Ahead: What’s Next?

As the economy shifts and changes, many people are curious about how President-elect Trump’s policies may influence future inflation rates. Some economists suspect that these future policies could increase inflation, creating uncertainty in the market. Therefore, the Fed is likely to adopt a wait-and-see strategy regarding additional rate cuts, making it important for families to stay informed about economic news.

Conclusion

The latest CPI data brings cautious optimism. With inflation showing signs of stabilization and interest rates likely to hold steady, families may find this to be a hopeful sign for their budgets in 2023. Understanding CPI better can also empower consumers to make well-informed decisions about spending and saving.